On January 4, 2024, the Government announced the “2024 Economic Policy Objectives” at the President-initiated “Public Debate on People’s Livelihoods.” Below are the Government’s key policies to support the semiconductor industry as part of the 2024 Economic Policy Objectives:

In 2024, the Government plans to accelerate the development of the semiconductor industry by providing intensive support for the creation of high-tech industry clusters.

The Government plans to support the creation of high-tech industry clusters to extensively develop the semiconductor, secondary battery, bio, future mobility, and hydrogen industries (the so-called High 5+ industries). To that end, the Government will provide in-depth assistance through close cooperation among relevant ministries. Specifically, for the prompt creation of high-tech industry clusters, the Government will (i) amend the guidelines for supporting infrastructure of specialized complexes, and (ii) establish comprehensive support plans for high-tech and material/part/equipment-specialized complexes in the first quarter of 2024. The Government is also in the process of formulating plans for distributing large-scale electricity to specialized complexes for high-tech strategic industries in a timely manner. Furthermore, the Government stated that it will provide Government-sponsored loans totaling at least KRW 150 trillion to finance high-tech industries over the next three years.

The Government’s timeline for supporting semiconductor-related clusters is as follows:

In 2024, the Government plans to maintain the tax benefits for companies investing in the semiconductor industry.

Since January 2023, the amended Special Tax Treatment Control Law (namely, the “K-Chips Act”) has been implemented to increase the tax deduction rates for national strategic technologies (including semiconductor-related technologies) and re-introduce the temporary tax deduction system for investments. To stimulate investments in facilities and R&D, the Government decided to extend the temporary tax deduction for facility investments for one year until December 2024. Such tax deduction benefits are available for both domestic and overseas-invested companies.

Tax Deduction Rates (%) for Facility Investments Added with the Temporary Tax Deduction Rates

|

Category |

Deduction Rate for Current Investment Amount (Basic Deduction) |

Deduction Rate for Increased Investment Amount (Additional Deduction) |

||

|

Large Companies |

Middle-Standing Companies |

Small and Medium-Sized Enterprises |

||

|

General Technologies |

1 → 3 |

5 → 7 |

10 → 12 |

3 → 10 |

|

Newly Emerging and Original Technologies |

3 → 6 |

6 → 10 |

12 → 18 |

4 → 10 |

|

National Strategic Technologies |

15 |

15 |

25 |

|

In addition, the Government decided to temporarily raise the tax deduction rate for general R&D investments by 10% until December 2024. This is the first time the Government temporarily increased the tax deduction for R&D investments.

Tax Deduction Rates (%) for R&D Investments in General Fields

|

Category |

Large Companies |

Middle-Standing Companies |

Small and Medium-Sized Enterprises |

|

Current Investment Amount |

2 at maximum |

8 - 15 |

25 |

|

Increased Investment Amount |

25 → 35 |

40 → 50 |

50 → 60 |

※ The company may choose whether it will receive tax deduction on the current investment amount or the increased investment amount.

Furthermore, the Government will provide financial assistance for facility investments in high-tech industries, including the semiconductor, secondary battery, future car, and robot industries. In January 2024, the Government will introduce a procedure called “Investment Express,” which helps companies with their investment-related difficulties through cooperation with economic organizations, associations and local governments.

The major Government ministries are preparing detailed guidelines for supporting the semiconductor industry in 2024.

On January 15, 2024, the Government announced the ministries’ joint plan to establish a mega semiconductor cluster as part of the post-debate measures.

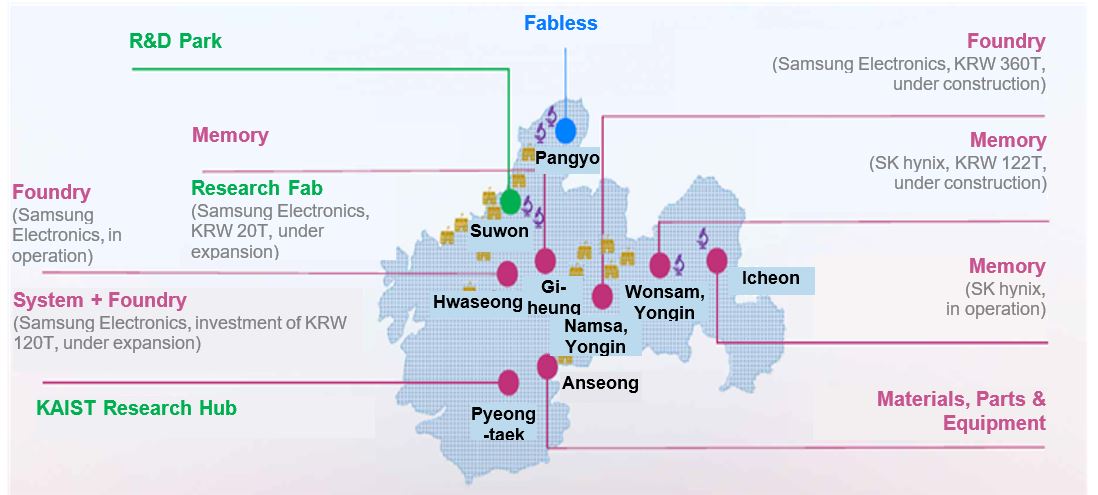

According to the plan, the Government will establish the world’s largest and most advanced mega semiconductor cluster by building three R&D and education hubs (in Pangyo, Suwon, and Pyeongtaek) within the mega cluster with the aim to achieve the market share of 10% in the global system semiconductor market and the supply chain independence rate of 50%.

The mega semiconductor cluster will consist of (i) fabless companies in Pangyo, (ii) manufacturing hubs (e.g., memory producers and foundries) in Hwaseong, Yongin, Icheon, and Pyeongtaek, (iii) materials, parts, and equipment manufacturers in Anseong, and (iv) advanced research hubs in Yongin, Giheung, and Suwon. It will become the largest production base for cutting-edge memory semiconductors with the world’s largest scale (21.02 million m2) and the world’s highest production volume. In addition, the Government plans to construct 16 fabs by investing a total of KRW 622 trillion by 2047.

Vision for Mega Semiconductor Cluster

※ Source: Press Release of the Ministry of Trade, Industry and Energy and the Ministry of Science and ICT dated January 15, 2024

In order to establish such mega cluster, the Government announced the following four tasks for development:

|

Task |

Detailed Plans |

|

Building Infrastructure and Investment Environment |

|

|

Ecosystem |

|

|

Unrivaled Technologies |

|

|

Talent |

|

The Government’s latest guidelines did not contain any new regulation on the semiconductor industry. However, if a national strategic technology under the K-Chips Act falls within the following categories, the national strategic technology remains subject to the regulations (e.g., export control) under relevant act(s).

-

(i) “National Core Technology” under the Act on Prevention of Divulgence and Protection of Industrial Technology, which was defined for the purpose of protecting industrial technologies; or

-

(ii) “National High-Tech Strategic Technology” under the Act on Special Measures for Strengthening the Competitiveness of, and Protecting National High-Tech Strategic Industries, which was defined for the purpose of fostering and protecting national strategic industries.

Outlook

Starting the year 2024, the Government again introduced innovative measures to support the semiconductor industry. This is seen as the Korean Government’s move to secure the leading position in the future semiconductor market and national economic security by establishing the world’s largest mega cluster, in consideration that the semiconductor industry is Korea’s key industry that determines the future of the nation, and other countries such as the US, Japan, Germany, and Taiwan are making movements to build semiconductor clusters. In particular, the Government’s tasks for developing the mega cluster include plans that significantly benefit not only domestic, but also overseas-invested companies. Accordingly, overseas-invested companies with relevant technologies are encouraged to pay attention to the Korean Government’s initiative of creating a mega cluster and positively consider having a research or production base in Korea. In 2024, the Government will also provide temporary tax deduction benefits to companies investing in facilities and R&D.