Holding the 14th Emergency Economic Meeting for People’s Livelihood (the “Economic Meeting”) on March 15, 2023, the Government intensively discussed strategies to foster the national high-tech industries and plans to establish a national high-tech industrial belt. The participants in the Economic Meeting included the Deputy Prime Minister for Economy, ministers from related ministries (i.e., Ministry of Trade, Industry and Energy (“MOTIE”); Ministry of Land, Infrastructure and Transport (“MOLIT”); Ministry of SMEs and Startups; Ministry of Science and ICT; Ministry of Education; Ministry of Agriculture, Food and Rural Affairs; and Ministry of Environment), the Chairman of the Financial Services Commission, and the minster of the Office for Government Policy Coordination.

In connection with the strategies to foster the national high-tech industries, the Government aims to take the leadership in the high-tech industries, which are not only the growth engine for the country and companies but also the strategic assets for economic security. For this, the Government will be pushing ahead with the six national projects with extensive support to (i) secure super-gap technologies, (ii) nurture talented individuals capable of creating innovation, (iii) establish region-specific clusters, (iv) create a robust ecosystem, (v) emerge as a country specialized in attracting investments, and (vi) strengthen the trade capabilities.

The government has announced its plan to actively support six core industries (i.e., semiconductor, display, secondary battery, bio, future car, and robotics sectors) in which Korea has strengths. For the semiconductor sector in particular, the government plans1 to establish the world’s largest cluster in Gyeonggi-do for cutting-edge system semiconductors.

To transform Korea into one of the most investor-friendly countries, the Government has decided to (i) significantly increase tax deduction for investments, (ii) provide support for establishing essential infrastructure such as power and water facilities, and (iii) introduce global standard-based rules and a licensing timeout system2 to accomplish deregulation to the level of Korea’s competing countries by drastically streamlining regulations and the licensing system that hinder corporate investments.

Enactment of the K-Chips Act - Companies Investing This Year will be Eligible for Temporarily Increased Tax Benefits

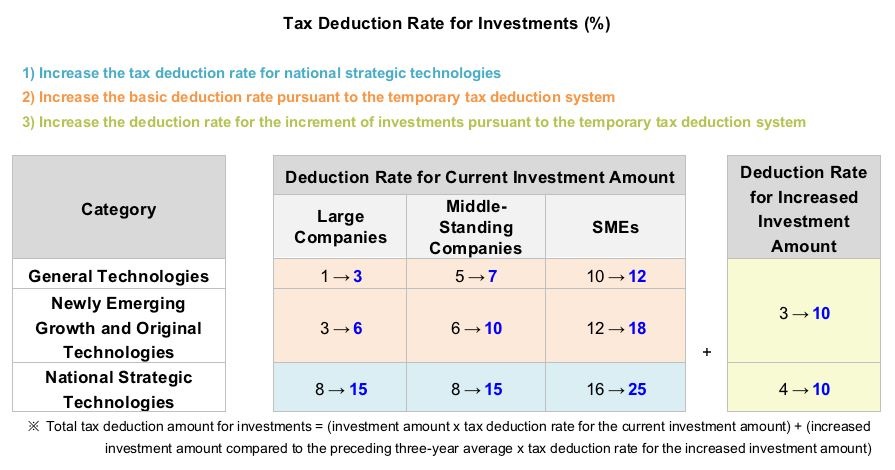

On April 11, 2023, the Special Tax Treatment Control Law was amended (the “Amended STTCL”; namely, the “K-Chips Act”) with key provisions to increase the tax deduction rate for national strategic technologies, including those related to semiconductors, and reintroduce a temporary tax deduction system for investments. The Amended STTCL will be applicable to investments made in January 2023 and onwards.

Key provisions of the Amended STTCL are summarized as follows:

-

Raise the tax deduction rate for facility investments in national strategic technologies, including those related to semiconductors.

-

Introduce a temporary tax deduction system for investments to temporarily increase their tax deductions for the year 2023 – i.e., increase the basic deduction rate, and provide an additional 10% tax cut for the increased amount of investments compared to the preceding three-year average.

Tax deduction benefits under the Amended STTCL are applied equally to domestic companies and foreign-invested companies, and companies investing in 2023 are eligible for drastic tax benefits as explained in the example below.

When a large company (“Company A”) annually invests KRW 100 billion in facilities for newly emerging growth and original technologies and makes an additional investment of KRW 50 billion in 2023 (i.e., KRW 150 billion in total), it will be eligible for temporary tax deductions and receive a tax cut of KRW 17 billion in total for two years. This means that an additional tax cut of KRW 5 billion will be offered to Company A, compared to any additional investment to be made in 2024.

Enactment of K-Chips Act - Companies Investing in National Strategic Technologies, Including Those Related to Semiconductors, will be Eligible for More Tax Benefits

The Amended STTCL provides more tax deduction benefits to investments in national strategic technologies. Whether a technology falls under the category of national strategic technologies is determined through the deliberation process of the R&D Tax Deduction Deliberation Committee. Nonetheless, tax deductions for national strategic technologies can be applied on an ex-ante basis before going through the deliberation process.

“National strategic technologies” are defined to designate the technology areas eligible for tax deductions, and their scope is set forth in the Enforcement Decree of the STTCL. The concept of national strategic technologies is different from that of “national core technologies” under the Act on Prevention of Divulgence and Protection of Industrial Technology (the “ITA”), which are defined to prevent a leakage of industrial technologies, or that of “national high-tech strategic technologies” under the National High-Tech Strategic Industry Act, which are defined to nurture and protect national strategic industries. National strategic technologies in the field of semiconductors encompass a very wide range of technologies including the following: (i) design and manufacturing technologies for advanced memory chips; (ii) design and manufacturing technologies for next-generation memory chips (STT-MRAM, PRAM, ReRAM, PIM); (iii) SoC (7nm or smaller) design and manufacturing technologies for high-performance computing; (iv) SoC design and manufacturing technologies for next-generation digital devices; (v) design, manufacturing and packaging technologies for high-performance micro-sensors; (vi) design and manufacturing technologies for automotive semiconductors; (vii) design and manufacturing technologies for semiconductors with higher energy efficiency; (viii) design and manufacturing technologies for semiconductors used in next-generation digital devices and vehicles; (ix) manufacturing process, and process design technologies, for 7nm- or smaller SoC in the field of foundry for the development and mass-production of SoC semiconductors; (x) materials/equipment/equipment parts design and manufacturing technologies for advanced memory chips, next-generation memory chips, and SoC semiconductor foundries; (xi) design and validation technologies for foundry IP; (xii) test technologies for high-performance and high-efficiency system semiconductors, and design and manufacturing technologies for test-related equipment and parts; (xiii) manufacturing technologies for secondary battery packs with high energy density; and (xiv) parts/materials/cell/module manufacturing technologies for high-performance lithium secondary batteries. Therefore, when investing in technical development related to semiconductors, it is essential to check if the invested technology falls under the category of national strategic technologies to confirm eligibility for tax deduction benefits.

Protection and Export Control of Semiconductor Technologies Expected to be Further Enhanced

The Government is expected to clamp down on cross-border technology leaks by acknowledging semiconductor technologies as security assets, while actively supporting and nurturing the semiconductor industry.

Under the ITA, technologies designated and protected as “national core technologies” are those whose leakage abroad may have a material adverse effect on national security and development of the national economy because they have high technological and economic values in the domestic and overseas markets, or because they bring high growth potential to the related industries. For the export or M&A of national core technologies, permission must be obtained from the Minister of the MOTIE. The government is anticipated to clamp down on cross-border leaks of national core technologies. The MOTIE reportedly plans to conduct a comprehensive re-examination of the scope of national core technologies by the end of 2023 in order to protect such technologies.

On March 31, 2023, the Japanese Ministry of Economy, Trade and Industry announced a policy to add 23 types of advanced semiconductor equipment to the scope of items subject to export control, and stated that the policy would come into force in July 2023. This measure taken by the Japanese government seems to be intended to keep China in check by joining the semiconductor regulatory trends led by the US against China. However, this is unlikely to have a major impact on Korea because Japan has adopted a plan to simplify the export licensing process for countries including the US, Korea, and Taiwan.

Future Prospects

When pledging to make Korea a semiconductor superpower, the new government reiterated its ambition to exert full efforts in nurturing the semiconductor industry. This policy stance has been maintained since the launch of the new government. Recently, the outline of the Government’s semiconductor support policies is becoming clearer: the Government is reportedly endeavoring to secure a stable semiconductor supply chain and prevent cross-border technology leaks by taking an approach from the perspective of economic security, in addition to providing various tax benefits to attract investments in the semiconductor industry. The Korean Government’s strategic plan to secure super-gap technologies, with an aim to build a global high-tech cluster in Korea through the establishment of national high-tech industrial complexes, is likely to serve as a great opportunity to both domestic companies and foreign-invested companies with technological prowess. As such, it is important for companies in the related industries to appropriately respond to the government’s semiconductor support policies and regulations pertaining to technology protection.

1 As part of the “strategies to foster the national high-tech industries,” the world’s largest mega-cluster for the system semiconductor sector will be established by attracting new and large-scale private investments. More specifically, a new cluster for cutting-edge system semiconductors will be established in Gyeonggi-do by 2042 with a scale of KRW 300 trillion, which is the world’s largest single complex. In the new cluster, five fabs will be built for the manufacturing of advanced semiconductors, in addition to attracting up to 150 businesses including outstanding domestic and foreign materials/parts/equipment companies and fabless companies. Once the new cluster is established, the world’s largest semiconductor mega-cluster will be completed, interconnecting the existing manufacturing complexes (in Giheung, Hwaseong, Pyeongtaek, Icheon, etc.) with nearby materials/parts/equipment companies and the Pangyo Fabless Valley.

2 A system whereby a licensing application is considered to have been processed if it has not been processed for up to 60 days without any special reason.

Related Topics