On December 22, 2025, the Financial Supervisory Service (the "FSS") announced a major organizational restructuring plan designed to: (i) establish a supervisory framework focused on proactive consumer protection; (ii) strengthen its capabilities to eradicate financial crimes that harm people's livelihoods; and (iii) reinforce its organizational structure in response to changes in the financial environment.

The organizational restructuring is significant as it is the first major reorganization undertaken since FSS Governor Chanjin Lee took office. The reorganization is viewed as a comprehensive overhaul of the FSS organization, intended to firmly embed "financial consumer protection"—a principle the Governor has consistently emphasized—as the top priority across all of the FSS's functions. The specific details of the restructuring, summarized below, signal the FSS's future supervisory priorities, including strengthening proactive consumer protection measures and eradicating financial crimes that harm people's livelihoods.

|

1. |

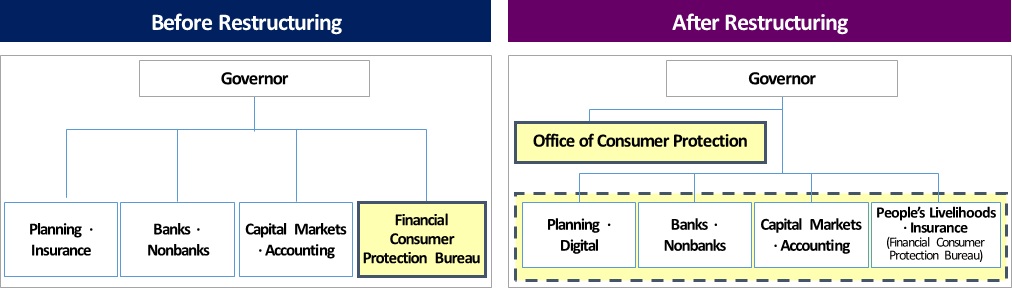

Establishment of a Supervisory Framework Focused on Proactive Consumer Protection [Reorganization structure focused on proactive consumer protection]

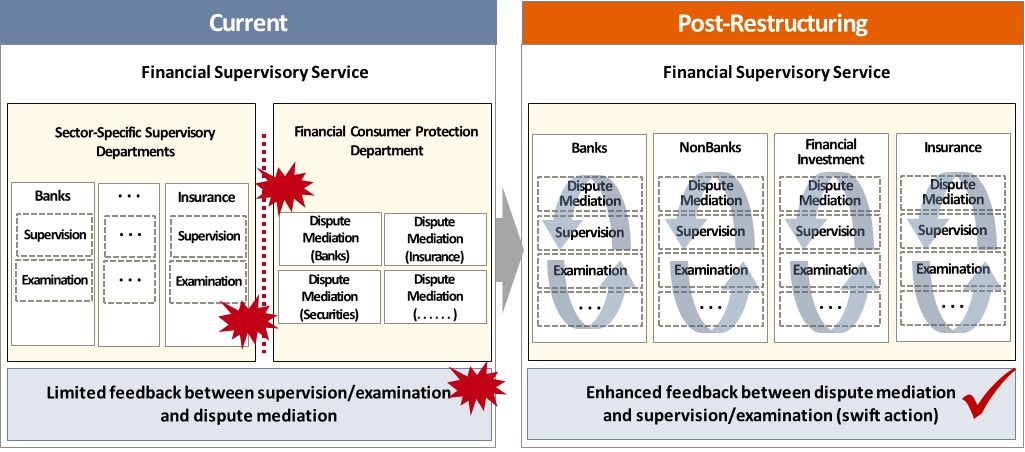

※ Source: FSS press release, "Financial Supervisory Service to Implement Organizational Restructuring,"dated December 22, 2025 The Office of Consumer Protection will evaluate the FSS's supervisory activities from a consumer protection perspective and set the direction for future policies. It will also strengthen supervision from the stage of structuring, designing, and reviewing financial products so that risks are assessed from the consumers' standpoint, thereby helping to prevent harm to consumers. [Enhancing organic feedback between redress and preventive functions]

※ Source: FSS press release, "Financial Supervisory Service to Implement Organizational Restructuring,"dated December 22, 2025

|

|

2. |

Capability Building to Eradicate Financial Crimes that Harm People's Livelihoods |

|

3. |

Reinforcement of the Organizational Structure in Response to Changes in the Financial Environment |

|

4. |

Establishment of Functions Dedicated to Facilitation of Government Priorities |

On the date of the announcement, the FSS appointed individuals with the required and proven skill sets to head the various departments under the Office of Consumer Protection. The regular personnel appointments are scheduled for completion by mid-January 2026, thereby enabling the timely implementation of the organizational restructuring focused on financial consumer protection.

[1] The Office of Consumer Protection will consist of 5 departments: Consumer Protection Supervision Department, Consumer Damage Prevention Department, Consumer Communications Department, Consumer Rights Protection Department, and Supervisory Innovation Department.

Related Topics

#Financial Supervisory Service #FSS #Organizational Restructuring