The Ministry of Trade, Industry and Energy and the Korea Power Exchange have announced the “2025 Competitive Bidding for the Clean Hydrogen Power Generation Market” (available in Korean, Link) to further reduce greenhouse gas emissions and enhance the hydrogen ecosystem.

The bidding for the Clean Hydrogen Power Generation Market will open for the second time following its inaugural bidding last year. Key features of this second bidding include certain policy changes designed to improve bidding process, align more closely with industry needs, and promote competitiveness. Notably, the bidding announcement introduces new measures to mitigate risks that businesses may face such as the foreign exchange-linked settlement system and hydrogen volume borrowing system.

|

1.

|

Summary of Announcement

In the 2025 bidding announcement, the total bidding quantity (including ammonia) is set at 3,000 GWh, which is significantly lower than the previous year’s announcement (i.e., 6,500 GWh). The trading period is set to be 15 years, starting from the commencement of commercial operations, provided, that actual power generation is required to begin by 2029, following a three-year project preparation period (with a one-year grace period).

Any persons or entities desiring to participate in the bidding are required to hold a power generation business license or submit an application for a license (or modification thereof) by the deadline specified in the bidding announcement. Additionally, they must satisfy certain financial requirements, including, but not limited to, (i) having a credit rating of BB- or higher and (ii) maintaining an equity capital ratio of at least 15%. Acquiring a clean hydrogen certificate is a mandatory requirement (for the avoidance of doubts, the participants may use the Korea Energy Economics Institute’s preliminary review consulting report from 2024 for their benefit, provided, that there have been no substantial changes) as well as complying with a mixing rate of at least 20%.

The key details of this year’s bidding announcement compared to those of the last year’s announcement are outlined as follows:

|

|

Classification

|

2024 Bidding Announcement

|

2025 Bidding Announcement

|

Remarks

|

|

Bidding Quantity

|

6,500GWh

|

3,000GWh

|

|

|

Transaction Period

|

15 years

|

Same as last year

|

|

|

Currency Risk

|

KRW-fixed price settlement

|

Currency exchange rates will be adjusted at the time of settlement

|

Introduction of Foreign Exchange-linked Settlement System

|

|

Method of Performance

|

Unfulfilled quota carryover system

|

Unfulfilled volume to carryover + volume borrowing system

|

Introduction of Hydrogen Volume Borrowing System

|

|

Evaluation Criteria

|

Price considerations (60 points) + Non-price considerations (40 points)

|

Same as last year

|

|

|

Project Preparation Period

|

Three years (up to one year grace period)

|

Same as last year

|

|

|

2.

|

Foreign Exchange-Linked Settlement System

The most significant change in this bidding announcement is the introduction of the “foreign exchange-linked settlement system.” Previously, settlements were conducted at a fixed price in KRW, having business operators exposed to all currency fluctuation. With this new system, however, fuel costs - as part of the generation costs linked to the exchange rate - will be adjusted based on the actual exchange rate at the time of settlement compared to using the base exchange rate. This approach is anticipated to reduce the risk associated with the exchange rate fluctuations for clean hydrogen fuel, which is predominantly delivered from overseas markets.

|

|

Previous Settlement System

|

Fixed Costs + Variable Costs

|

|

New Settlement System

|

Fixed Costs + Operating Costs + [Fuel Costs X Exchange Rate of Applicable Month/Base Exchange Rate]

|

|

3.

|

Hydrogen Volume Borrowing System

In addition to the existing hydrogen volume carryover system, which permits carry-over of any unused volume during the current year to the following year, the “hydrogen volume borrowing system” has been introduced. Under this new system, power generators can advance next year’s allocated hydrogen volume to meet the current year’s obligations to the extent applicable.

A successful bidder may carry over up to 10% of the current year’s annual contract volume to the following year, or to advance up to 10% of the next year’s annual contract volume for use during the current year. However, such kind of volume advancing is only permitted for purposes of planned preventive maintenance of facilities and requires prior submission of the proposal containing the explanation and the proposed volume to be advanced to the Korea Power Exchange for review and approval.

This new policy attempts to provide liquidity to businesses so that they can proactively address situations where they cannot meet certain contracted power generation volume due to the planned preventive maintenance of facilities and/or disruptions relating to the supply of imported fuels, thereby improving transactional flexibility for the benefit of businesses.

|

|

4.

|

Timeline and Considerations

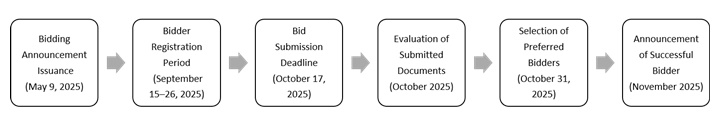

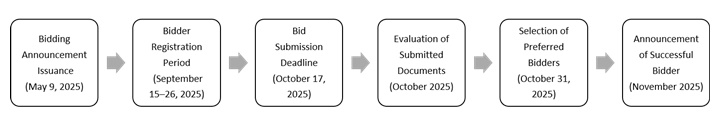

Any persons or entities desiring to participate in the 2025 bidding must register as bidders between September 15, 2025 and September 26, 2025. The proposal and supporting documents must be submitted by October 17, 2025. The final winner(s) will be announced in November, 2025.

|

To participate in the upcoming bidding, the participants must submit the Levelized Cost of Energy (the “LCOE”) for clean hydrogen power generation. The LCOE, serving as the bidding price, includes the sum of fixed, operating and fuel costs. Only the qualified proposals that do not exceed both (i) the total LCOE and (ii) a fuel cost index cap (for the avoidance of doubt, submitted information will be kept confidential) will be permitted to proceed to the evaluation phase.

According to the bidding announcement, even if a bid is successful, the contract may be terminated if an operator (i.e., a winning bidder) (a) fails to meet the clean hydrogen grade and fuel introduction stability requirements, (b) changes the bid price, or (c) if a “long-term delay” in the construction is anticipated (a “long-term delay” is defined as failing to invest in the amount equal to (or greater than) 30% of the total investment cost by 18 months after the date of contract signing). The participants should submit their bids only after thoroughly reviewing their business plans, with particular attention to their plans for long-term fuel procurements throughout applicable transaction terms.

|

5.

|

Implications

The 2025 clean hydrogen power generation bidding market has been designed to reduce the burden on businesses and boost participation by implementing the foreign exchange-linked settlement system and the hydrogen volume carryover system. Notably, the easing of exchange rate risks is a significant improvement that enhances project predictability, especially given the heavy dependence on imported clean hydrogen and ammonia as raw materials.

Despite these policy improvements, clean hydrogen still faces relatively high production costs and requires a stable supply chain. Businesses are encouraged to actively leverage the new systems introduced in this year’s bidding announcement to minimize risks and develop strategies for enhancing fuel price stability, satisfying mixing rate requirements, and ensuring efficient performance of contractual obligations.

However, even with the introduction of the aforementioned systems, the risk associated with ensuring a stable supply of clean hydrogen fuel continues to remain with the participants. Therefore, it is crucial to thoroughly review and optimize the risk allocation structure during the negotiation for fuel supply agreements.

More particularly, certain legal clauses—such as force majeure clauses in long-term fuel supply agreements, indemnification clauses for supply delays, and mechanisms for addressing price fluctuations—are critical to the project stability. Thus, a thorough legal review will be essential starting from the bid preparation stage.

|

[Korean Version]