As mentioned in our previous newsletter, the Financial Services Commission (the “FSC”) held an “Industry Consultation on Sustainability Disclosure Standards” on September 19, 2024 to gather feedback from corporations on its “Announced Draft Sustainability Disclosure Standards” (Link). Based thereon, the FSC is expected to continue developing its legal framework for climate and other sustainability disclosures for listed companies and further developments should be monitored.

In this regard, on March 5, 2025, the Sustainability Standards Board of Japan (the “SSBJ”) announced its inaugural sustainability disclosure standards (the “SSBJ Standards”), aligned to standards published by the International Sustainability Standards Board (the “ISSB”), which we note for reference in light of the legislative developments in Korea (Link 1, Link 2).

The SSBJ was established in July 2022 with the aim of developing sustainability disclosure standards in Japan and contributing to the development of international standards as well.

The SSBJ Standards are comprised of the three disclosure standards listed below.

-

Criteria for Application of Sustainability Disclosure Standards (“Universal Sustainability Disclosure Standard”)

-

General Disclosure Standards (“Theme-based Sustainability Disclosure Standard No. 1”)

-

Climate-related Disclosure Standards (“Theme-based Sustainability Disclosure Standard No. 2”)

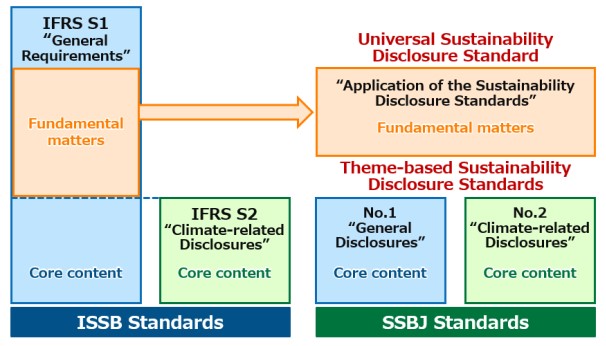

The SSBJ stated that the SSBJ Standards were premised on consistency with the ISSB’s IFRS Sustainability Disclosure Standards (the “ISSB Standards”). For the convenience of users, the SSBJ divided the ISSB Standard’s “General Requirements for Disclosure of Sustainability-related Financial Information (“IFRS S1”)” into two separate sections. More specifically, general requirements that are not included in the “Core content” section of IFRS S1 have been incorporated into the SSBJ Standard’s Universal Sustainability Disclosure Standard. General requirements included in the “Core content” section of IFRS S1, concerning sustainability-related risks and opportunities (e.g., governance procedures used by corporations to monitor these risks and opportunities, strategies for managing them, and processes for identifying and evaluating them) have been included in the SSBJ Standard’s Theme-based Sustainability Disclosure Standard No. 1. Meanwhile, climate-related disclosure requirements have been included in the SSBJ Standard’s Theme-based Sustainability Disclosure Standard No. 2. Please see the figure below for a comparison between the ISSB Standards and the SSBJ Standards.

The SSBJ plans to require corporations listed on the Prime Market of the Tokyo Stock Exchange to comply with the SSBJ Standards and to cohere the development of the standards with the legal framework for sustainability disclosure standards under securities laws and regulations as promulgated by the Financial Services Agency of Japan. The SSBJ has announced the following schedule and roadmap for the adoption of the disclosure requirement:

-

Voluntary disclosure to start for the fiscal year ending March 31, 2026;

-

Mandatory disclosure to start for companies with a market capitalization of JPY 3 trillion or more (69 companies) for the fiscal year ending March 31, 2027;

-

Mandatory disclosure to start for companies with a market capitalization of JPY 1 trillion or more (179 companies) for the fiscal year ending March 31, 2028; and

-

Mandatory disclosure to start for companies with a market capitalization of JPY 500 billion or more (294 companies) for the fiscal year ending March 31, 2029.

It would be advisable to keep informed on the contents of the SSBJ Standards, as well as their implementation and adoption schedule, as they may tell as to the contents and schedule of the sustainability disclosure requirements for Korean listed companies to be adopted by the FSC.

Related Topics

#Sustainability #SSBJ #Disclosure Standards #Corporation Law #Legal Update