As addressed in our earlier newsletter in June (Link), the Financial Services Commission (“FSC”) announced a proposed amendment to the Regulation on Securities Issuance and Disclosure on May 28, 2024. This amendment introduces stricter regulations on (i) disclosures regarding convertible bonds (“CBs”) and bonds with warrants (“BWs”), and (ii) the conversion price of CBs and convertible shares as well as the exercise price for preemptive rights with respect to BWs.

As a latest development, the FSC amended the Regulation on Securities Issuance and Disclosure on November 13, 2024 (the “Amended Regulation”) to (i) strengthen regulations on disclosures regarding the issuance and circulation of CBs, BWs and (redeemable) convertible preferred shares (“CB/BWs”), (ii) enhance the conversion price adjustment (i.e., refixing) mechanism, and (iii) clarify the base date for calculation of conversion prices. The key details of the Amended Regulation are as follows.

|

1.

|

Strengthened Regulations on Disclosures Regarding the Issuance and Circulation of CB/BWs

When a company designates a call option exerciser with respect to CB/BWs or assigns call options on CB/BWs to a third party, the Amended Regulation requires such company to disclose material information such as the details of the option exerciser, whether consideration was received and the calculation method for such consideration (in case of assignment of call options to a third party). This amendment addresses the common disclosure practice where companies issuing CB/BWs simply state that the option would be exercised by “the company or a person designated by the company,” failing to provide meaningful information about who will be exercising the option.

The Amended Regulation introduces additional disclosure requirements regarding the acquisition and disposition of CB/BWs, including the reason for any acquisition prior to maturity (if any) and the anticipated method of disposition (e.g., cancellation or resale). Some companies have been reported to resell CB/BWs that they acquired before maturity to the largest shareholder. The newly introduced requirement attempts to address concerns that such practice may be misused for undue expansion of management control or for transactions posing conflicts of interest and unfair trading in the capital market.

|

|

2.

|

Strengthened Regulations on Conversion Price Adjustments for CB/BWs

With respect to conversion price adjustments for CB/BWs through refixing conducted in order to account for stock price fluctuations, the Amended Regulation sets the minimum level of refixing at 70% of the initial conversion price. Any adjustment below this 70% threshold would require a special resolution of the general meeting of shareholders. This presents a significant change from the original regulations, which permitted adjustments below the 70% threshold through either (i) a special resolution of the general meeting of shareholders, or (ii) the articles of incorporation. There have been cases where this minimum level requirement was circumvented by way of broad provisions in the articles of incorporation that allow for refixing below 70% of the initial conversion price for general corporate purposes such as financing and asset purchases.

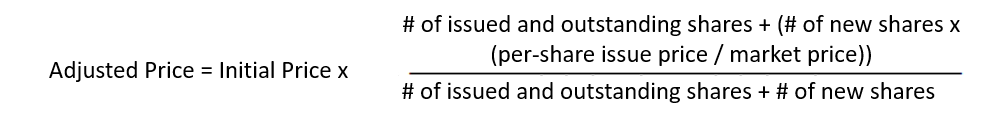

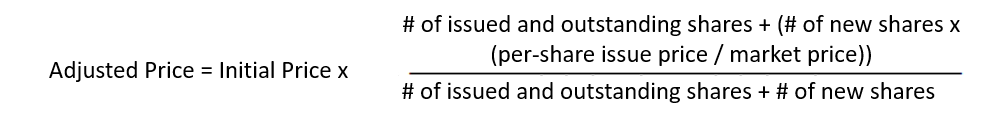

The Amended Regulation also introduces new restrictions on conversion price adjustments that are made to account for dilutive effects from corporate actions such as capital increases and stock dividends (i.e., anti-dilution adjustments). Under the Amended Regulation, downward adjustments to conversion prices cannot go below the price that reflects the dilution effects, which is calculated as shown below. This change addresses loopholes in previous regulations where companies freely decided on the adjustment method based on board resolutions, sometimes resulting in excessive downward adjustments to conversion prices.

|

Formula to Reflect Dilution Effect on Value of Conversion Rights:

|

Where:

-

The number of issued and outstanding shares refers to the total number of issued and outstanding shares as of the date immediately preceding the adjustment event date;

-

The per-share issue price would be zero in the case of bonus issues and stock dividends; and

-

The market price refers to the base share price—which is the basis for calculating the issue price set forth in the Regulation—or the theoretical ex-rights price (except for rights issues, where the base share price is calculated from the day immediately prior to the date on which an event for adjustment occurs).

|

|

3.

|

Clarification of the Base Date for Calculation of Conversion Prices for Privately Placed CB/BWs

Under the original regulations, the conversion price was calculated reflecting the market price as of the date immediately preceding the board resolution and the date of subscription. For privately placed CB/BWs, however, setting a subscription date serves little purpose since the purchaser is usually predetermined. There have been concerns about some companies arbitrarily setting the board resolution date as the subscription date, then deliberately postponing the payment date until the stock price goes up so as to secure a lower conversion price. To address this issue, the Amended Regulation requires the reference price as of the "actual payment date" to be reflected in the calculation of the conversion price for CB/BWs.

|

The Amended Regulation came into effect on December 1, 2024. As the regulations on listed companies’ issuance of CB/BWs will be significantly strengthened under the Amended Regulation, companies contemplating financing or corporate restructuring transactions through such instruments should ensure that the stricter regulations outlined above are taken into consideration in their transaction structuring.

[Korean Version]