As explained in the newsletter we issued at the beginning of February this year (Link), the Financial Services Commission (the “FSC“) held a meeting on January 23, 2024, where it announced its plan to improve the soundness of the convertible bond (“CB”) market. The FSC cited existing regulatory issues with CBs, including some major shareholders negatively affecting shareholder value by abusing the distinct characteristics of CBs, and expressed its intention to resolve the issues by (i) strengthening regulations on disclosures regarding the issuance and circulation of CBs, bonds with warrants and convertible shares, and (ii) improving regulations on the refixing of conversion prices to make them more reasonable.

Following the FSC’s meeting mentioned above, the FSC announced on May 28, 2024, a proposed amendment to the Regulation on Securities Issuance and Disclosure (the “Proposed Amendment”) (Link), which applies to CBs, bonds with warrants and convertible shares. We have summarized the key details of the Proposed Amendment as follows.

|

1. |

Stricter Regulations on Disclosures Regarding CBs and Bonds With Warrants |

|

2. |

Stricter Regulations on the Conversion Price of CBs and Convertible Shares and the Exercise Price for Preemptive Rights With Respect to Issuances of Bonds With Warrants |

|

(1) |

The arithmetic mean of (i) the one-month weighted arithmetic mean of the price of the stock of the listed company, (ii) the one-week weighted arithmetic mean of such stock price, and (iii) the one-day weighted arithmetic mean of such stock price for the latest trading day; |

|

(2) |

The one-day weighted arithmetic mean of such stock price for the latest trading day; and |

|

(3) |

The weighted arithmetic mean of such stock price on the date that is three trading days prior to the subscription date for the CBs (or the payment date if there is no subscription date) (or the weighted arithmetic mean of such stock price on the date that is three trading days prior to the actual payment date if the CBs are issued through a third-party allotment under Article 165-6 (1) 2 of the FSCMA and the period from the date of resolution of the board of directors for the issuance of the CBs to the date of payment is not less than one month).[1] |

In addition, the Proposed Amendment would require that any refixing of the minimum conversion price due to market price fluctuations must still result in a conversion price that is equal to at least 70% of the initial conversion price, with an exception allowing for an adjusted price less than 70% of the initial conversion price only if approved pursuant to a special resolution passed at a general meeting of shareholders – some companies had previously included exceptions in their articles of incorporation for general purposes such as simple financing and asset purchases, but such practice would no longer be allowed under the Proposed Amendment.

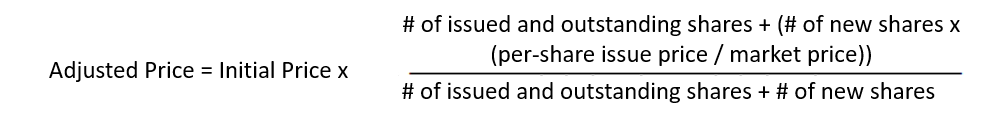

Unlike conversion price adjustments arising from market price fluctuations, in case of a conversion price adjustment arising from certain corporate actions of the relevant company, such as capital increases, stock dividends, etc., issuers have been able to freely decide how to adjust the price by board resolutions, which in some cases has resulted in companies setting excessively low conversion prices. In order to address this issue, the Proposed Amendment allows the conversion price to be lowered to no less than the price that reflects the dilution effect on the conversion rights as a result of capital increases, stock dividends, etc., calculated as follows:

Formula to Reflect Dilution Effect on Value of Conversion Rights:

|

Where:

|

Pursuant to Articles 5-24 and 5-24-2 of the RSID, the Proposed Amendment would also apply mutatis mutandis to bonds with warrants and convertible shares.

The Proposed Amendment will become effective in the third quarter of 2024 if it passes the relevant enactment procedures, including review by the Regulatory Reform Committee and resolution by the Securities and Futures Commission and the FSC, following the announcement period from May 28 through June 11. According to the addenda to the Proposed Amendment, the amended provisions would enter into force on the date of public announcement, and with respect to each affected company, would apply starting with the first issuance of CBs, bonds with warrants or convertible shares by resolution of such company’s board of directors after the Proposed Amendment comes into force.

If the Proposed Amendment takes effect, regulations on issuances by listed companies of CBs, bonds with warrants and convertible shares will be significantly strengthened. Therefore, companies considering raising capital or corporate restructuring through these types of issuances after the Proposed Amendment takes effect should make sure to account for the stricter requirements in their transaction structuring.

[1] Item (3) does not apply if the relevant CBs are issued through a third-party allotment under Article 165-6 (1) 2 of the FSCMA and the period from the date of resolution of the board of directors for the issuance of such CBs to the date of payment is less than one month.

Related Topics

#Convertible Bond #Bonds With Warrants #Shares #Corporation Law #Legal Update