As detailed in our previous newsletter in early February of this year (Link), the Financial Services Commission (“FSC”) and the Ministry of Justice (“MOJ”) announced on January 31, 2023 their “plans to improve dividend distribution procedures in line with global standards” that will allow companies to set their dividend record date to come after the general meeting of shareholders by bifurcating the record date for exercising voting rights and the record date for dividends. This change is designed to allow investors to make their investment decisions with the knowledge of the dividend amount determined at the general meeting of shareholders. In this regard, in January of this year, the MOJ issued an official ruling regarding the dividend record date under the Korean Commercial Code as outlined above, and in February, the Korea Listed Companies Association (“KLCA”) amended the model form of the articles of incorporation for listed companies regarding the dividend record date. When the FSC and the Korea Exchange (“KRX”) amended the Guidelines on Corporate Governance Disclosure this past October as detailed in a separate newsletter, the above improvements to dividend distribution procedures were also incorporated in the amendments (Link).

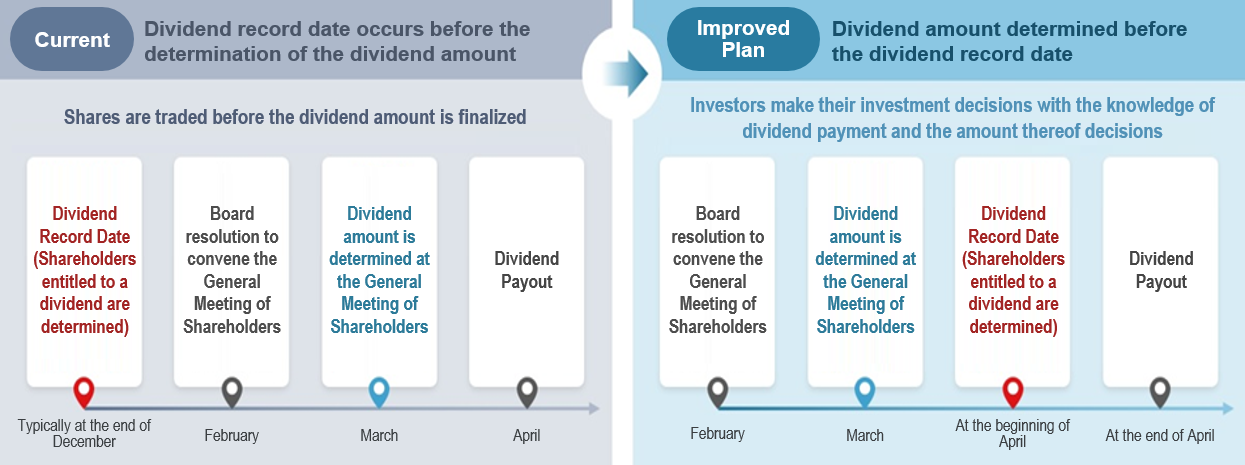

On December 5, 2023, the Financial Supervisory Service (“FSS”) issued a press release (available in Korean, Link) outlining the current status of listed companies preparing to improve the dividend distribution procedures announced as above and setting out the matters requiring investors’ attention as well as the requests to companies and its future plans. The following is an illustration of dividend distribution procedures in case the plans to improve dividend distribution procedures are adopted through an amendment of the articles of incorporation or otherwise:

Illustration of Plans to Improve Dividend Distribution Procedures

According to the above press release by the FSS, a considerable number of listed companies are cooperating with the regulatory authorities and following their recommendations to improve dividend distribution procedures, with 636 (28.1%) out of a total of 2,267 KOSPI or KOSDAQ-listed companies with fiscal year ending in December having amended their articles of incorporation and completed the preparations to improve the dividend distribution procedures. It has been announced that the KLCA and the KOSDAQ Listed Companies Association plan to render support by creating a bulletin board of listed companies’ dividend record dates on their respective websites so that investors can easily identify the dividend record date, dividend declaration date, type of dividends and other information relating to the companies they invest in. The FSS also announced that listed companies that have voluntarily improved dividend distribution procedures by amending their articles of incorporation will be granted extra points when being evaluated to become designated companies following good corporate disclosure practices. The FSS, KRX and other institutions also plan to provide active support so that the plans to improve dividend distribution procedures announced at the beginning of this year can be quickly established and implemented.

Listed companies or their shareholders will need to pay close attention to the developments surrounding the improvement of listed companies’ dividend distribution procedures. Listed companies will also need to refer to these developments in the course of preparing agendas related to the approval of dividends and amendment of the articles of incorporation at the ordinary general meeting of shareholders in 2024 and make necessary corporate disclosures.